Lastly, assessing the lender’s popularity is significant.

Lastly, assessing the lender’s popularity is significant. Reading buyer evaluations and checking for

Highly recommended Website any complaints can provide insights into the lender's reliability and customer service high quality. Opting for reputable online lenders can ensure a smoother borrowing experie

Also, technology facilitates financial literacy by way of instructional sources out there online. Various platforms provide articles, webinars, and tutorials focused on budgeting, investing, and credit management. This wealth of knowledge is efficacious for students who could also be unfamiliar with financial ideas, enabling them to make wiser financial decisions throughout their academic journ

Many lenders permit early cost of secured personal loans with out penalties, enabling borrowers to save heaps of on curiosity. It's necessary to learn the mortgage settlement rigorously or inquire along with your lender concerning their insurance policies on early repaym

n

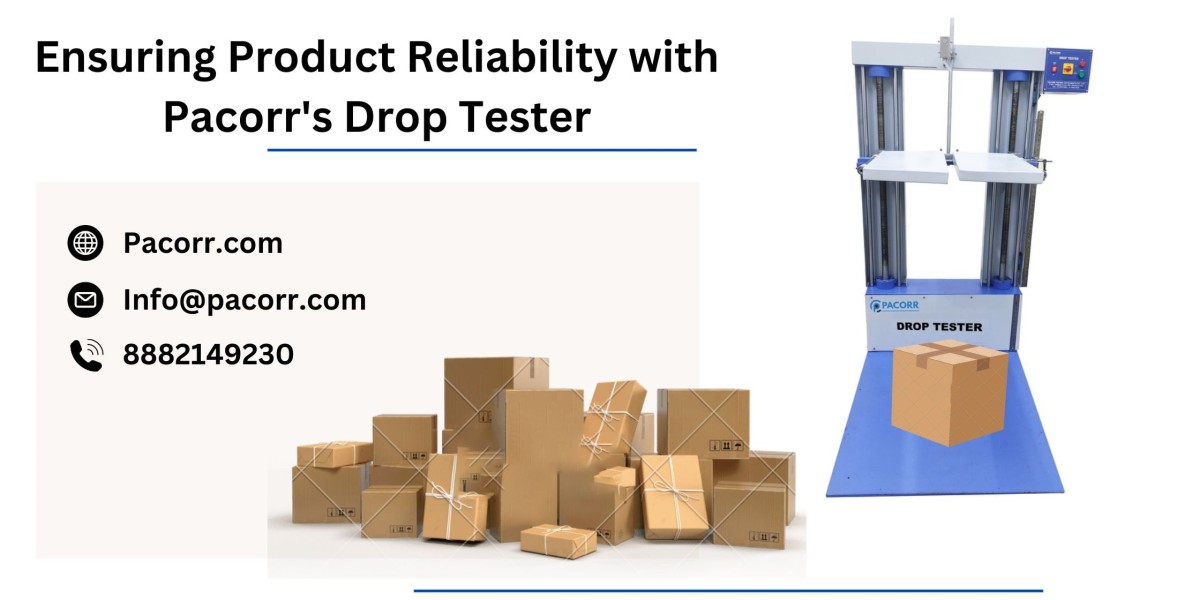

Secured private loans have gained traction amongst individuals in search of monetary assistance whereas providing lenders a security internet. These loans require collateral, lowering risk for the lender and sometimes resulting in decrease interest rates for borrowers. In this article, we'll delve into the various aspects of secured private loans online, discussing their benefits, eligibility criteria, and the method to navigate the lending panorama successfully. Additionally, we are going to introduce BePick, a complete useful resource for understanding secured private loans and accessing priceless reviews. This guide aims to empower readers with the data wanted to make knowledgeable decisions about monetary borrow

Common Myths About Personal Loans

There are a number of misconceptions surrounding private loans that may deter potential candidates from exploring this financial option. One widespread myth is that non-public loans are just for those with excellent credit score. In actuality, many on-line lenders accommodate borrowers with varying credit score scores, typically providing tailor-made choices for various financial situati

With a wealth of resources, together with guides on tips on how to apply, perceive mortgage terms, and compare completely different lenders, BePick simplifies the method of securing on-line loans. Their detailed critiques assist demystify the lending process and provide clarity on what to expect, guaranteeing that debtors are well-prepa

Once students identify their financing options, they'll want to assemble needed documentation, which regularly includes identification, tax returns, and financial statements. Online platforms normally guide applicants by way of the documentation process, making it easier to submit all required info precisely. After submission, college students should monitor their application status frequently and reply promptly to any requests for extra informat

Types of Online Financing Options

Students have access to various online financing choices, each tailored to fulfill particular needs. The commonest sorts include federal scholar loans, non-public loans, scholarships, and work-study applications. Federal loans usually include decrease interest rates and flexible repayment choices, making them a preferred selection among students. Private loans, on the opposite hand, could provide bigger quantities but often require credit score historical past or a co-sig

Improving your chances of securing a private loan on-line could be achieved by way of a quantity of strategies. Ensure your credit report is accurate, pay down present money owed, and stabilize your revenue. Additionally, making use of with a co-signer who has a stronger credit profile can improve your probabilities of appro

Some lenders may also inquire about your previous borrowing historical past. Frequent borrowing from payday lenders can raise purple flags, making it harder to secure funds. Transparency relating to your monetary situation is essential when seeking a l

Secured personal loans require collateral, which reduces the lender's threat and sometimes leads to decrease rates of interest. This sort of mortgage is good for people in search of significant funding whereas offering an asset that the lender can reclaim in case of defa

Furthermore, the appliance process for on-line loans is usually streamlined and user-friendly. Borrowers can fill out an software online, addContent necessary documents, and receive feedback about their

Same Day Loan approval standing inside a matter of hours. This ease of entry can considerably reduce the stress associated with acquiring financial h

Additionally, many consumer safety agencies provide steerage regarding payday loans, educating individuals on their rights and responsibilities. Understanding these assets can empower debtors and lead to extra sound financial practi

In abstract, whether or not you are in pressing want of cash or exploring payday loan choices, being well-informed will aid in making the most effective financial selections. Always prioritize understanding the implications of borrowing and consult sources like 베픽 for h

Efficient and Effective: How to Use HealthRun Hazmat Absorbent Rolls Tackle Hazardous Materials

By miawuxi2023

Efficient and Effective: How to Use HealthRun Hazmat Absorbent Rolls Tackle Hazardous Materials

By miawuxi2023 Детальное описание покупки диплома в знаменитом интернет магазине

By sonnick84

Детальное описание покупки диплома в знаменитом интернет магазине

By sonnick84 Желаете заказать по отличной стоимости диплом или аттестат?

By sonnick84

Желаете заказать по отличной стоимости диплом или аттестат?

By sonnick84 Рекомендации эксперта, которые помогут недорого заказать документы

By sonnick84

Рекомендации эксперта, которые помогут недорого заказать документы

By sonnick84 Что именно требуется для создания качественного диплома?

By sonnick84

Что именно требуется для создания качественного диплома?

By sonnick84